Maximize efficiency and plan for the future by analyzing the impact of key variables in various tax scenarios.

State policymakers regularly propose changes to tax laws to achieve policy objectives and examine their impact on household demographics and geographical areas, including cities, counties, and legislative districts. Implementing policy changes often results in disruptions to other strategic projects and initiatives, with timeframes ranging from days to weeks.

While the purpose of our tax system is to generate revenue, it also aims for fairness, efficiency, and enforceability, making it increasingly complex each year. Our solution, the RevHub Tax Policy Simulator, provides a tool to help plan for the future while maximizing efficiency in the present by delivering an analysis of the impact of key variables in each tax scenario, enabling users to create action plans and monitor progress over time.

RevHub Tax Policy Simulator

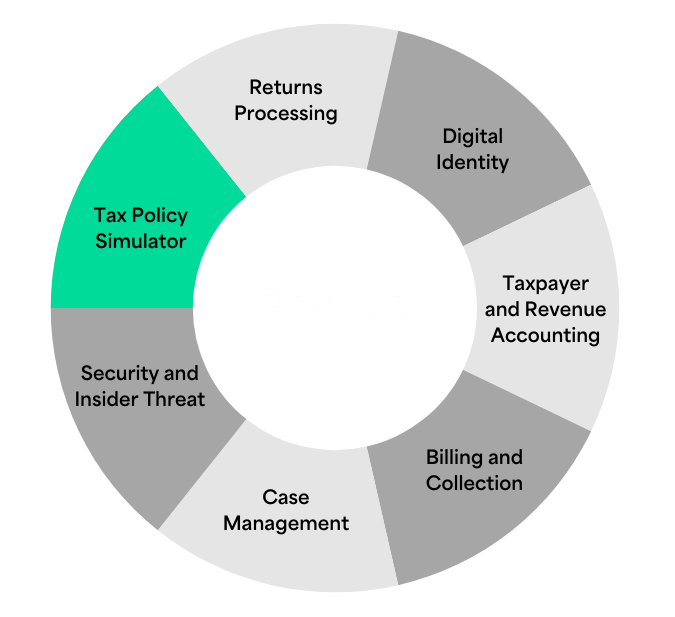

The RevHub Tax Policy Simulator is a module of RevHub, our comprehensive SaaS based enterprise platform for tax. Our Tax Policy Simulator is a versatile reporting and forecasting engine that goes beyond its name. It serves as a valuable resource for examining historical trends and making forecasts for the future. It not only functions as a robust reporting tool but also offers forecasting capabilities and the ability to explore hypothetical scenarios.

The Tax Policy Simulator can be customized to report on any data within RevHub, including data from third-party sources. With access to a wide range of data, it can fulfill reporting needs for any department and cover various tax types, such as Personal Income Tax, Sales Tax, Tobacco Tax, and Liquor Tax. Its flexibility makes it an invaluable tool for comprehensive tax reporting and analysis.

RevHub provides a modular platform for tax administration, allowing users to procure and implement individual modules such as the Tax Policy Simulator to address specific challenges or pain points. Additionally, users have the flexibility to add other modules as needed over time, ensuring continuous improvement and adaptability.