How State Departments of Labor Can Leverage Advanced Analytics to Prevent Unemployment Insurance Fraud

How State Departments of Labor Can Leverage Advanced Analytics to Prevent Unemployment Insurance Fraud

Last month the Department of Labor (DOL) announced the release of $653 million from the American Rescue Plan for states to modernize their unemployment insurance systems. The new funding is another sign that both federal and state officials are embracing lessons learned from COVID-19, when unemployment programs paid an estimated $87 billion to fraudulent claimants.

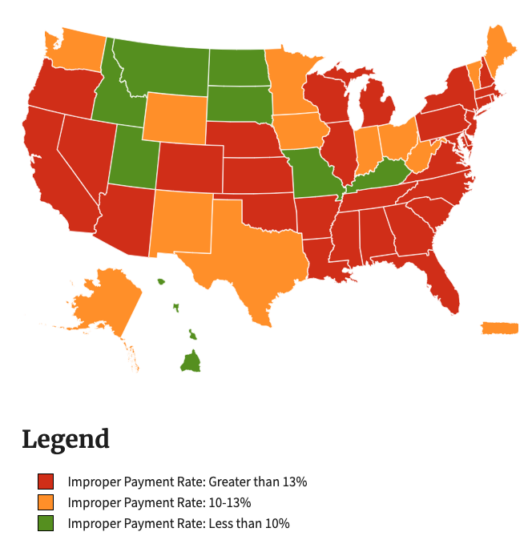

While COVID-19 spotlighted the issue, unemployment fraud, waste and abuse has been a perennial problem. The DOL estimates that inaccurate payments range, depending on the state, from as little as 5% to as much as 38%. That waste has a negative impact on state budgets and programs – and on the residents those programs serve.

But there is a solution. With the right technologies and approaches, state departments of labor can apply advanced analytics to effectively identify and root out fraud, waste and abuse related to unemployment benefits.

Advanced Techniques for Deterring Benefits Fraud

Unemployment fraud can take multiple forms. Employers might create false accounts to avoid tax liability. Claimants might submit false information or continue collecting benefits when they’re no longer eligible. Criminals might file false claims or defraud claimants through websites that mimic a state unemployment insurance portal.

State employment agencies typically work with federal, state and local law enforcement to identify and prosecute such fraud. Detection and prevention methods include cross-checking claims against employer data, verifying applicant identities, and investigating tips from members of the public.

But fraud schemes can be sophisticated. Fraudsters can access systems, acquire data and commit crimes across multiple channels – while remaining undetected by traditional business rules and monitoring tools. States need more effective approaches to identifying, detecting and stopping root causes of fraud, waste and abuse – before money gets paid out.

Using Artificial Intelligence and Machine Learning to Identify Fraudsters

Machine learning is a critical tool for fraud prevention. We can use details from known past cases to train a machine-learning (ML) algorithm to quickly determine the probability that a case is fraudulent. Of course, this technique requires knowing what fraud looks like, so it can be less effective against previously unseen fraud patterns.

Here’s where a graph-based approach can help. Rather than looking at a single claim as the unit of review, graph-based analysis looks for connections among multiple suspicious claims – like a large number of claims associated with a single username, email address, IP address or bank account.

ML-based pattern recognition can determine, for example, that an unusually high amount of claimant names are associated with a data breach at a single bank. That can be useful for uncovering claims from crime groups responsible for fraud clusters.

For example, when Voyatek deployed a variety of AI/ML models to analyze more than 3.1 million claims on behalf of our client, we not only prevented more than $1B in fraudulent unemployment benefits, but also reduced the backlog of claims so that legitimate claims could be expedited. In fact, the average duration of an investigation by this agency was reduced from 70 days to just over one day.

Unemployment insurance fraud, waste and abuse will continue to be a reality for state governments. But with the right technologies to enable advanced analytics and the right strategies for putting analytics to work, states can make measurable progress in shutting down fraud, saving taxpayer money and serving residents more effectively.